Smart meter rollout hits top speed

June 2025 was a month of two halves for the UK energy marketplace. On one hand, smart meter installations hit a year-to-date high. On the other, the number of customers switching suppliers fell to their lowest point in months.

Both trends are worth attention. The UK smart meter rollout is being hailed as a success in terms of pure numbers, but questions remain about its delivery and whether the potential benefits can be realised. Meanwhile, the decline in supplier switching is part of a continuing slide that affects households and businesses alike.

In this article, we’ll dive into the numbers and tell you more about them.

New highs for smart meter installation

Electralink’s latest figures show that 233,000 smart electricity meters were installed in June, beating May’s already strong total of 215,000. This was the highest monthly figure recorded so far in 2025, cementing the momentum built in the first half of the year.

Between January and June, 1.3 million smart meters were fitted. From a regional standpoint, East England led the way in June with 28,000 installations. Southern England and the East Midlands were joint runners-up with 23,000 each. At the lower end, South Wales recorded 6,518 installations and North Wales 9,719, showing a stark difference in pace between regions.

By the end of June, 26.1 million smart meters were operating across the country. More than two-thirds of households now have one, according to Energy UK. In further good news, customer satisfaction is high: five out of every six households with a smart meter say they are happy with it.

These adoption figures suggest that the rollout is reaching a broad base of customers. There has also been a concerted push to replace aged radio teleswitch meters with smart equivalents.

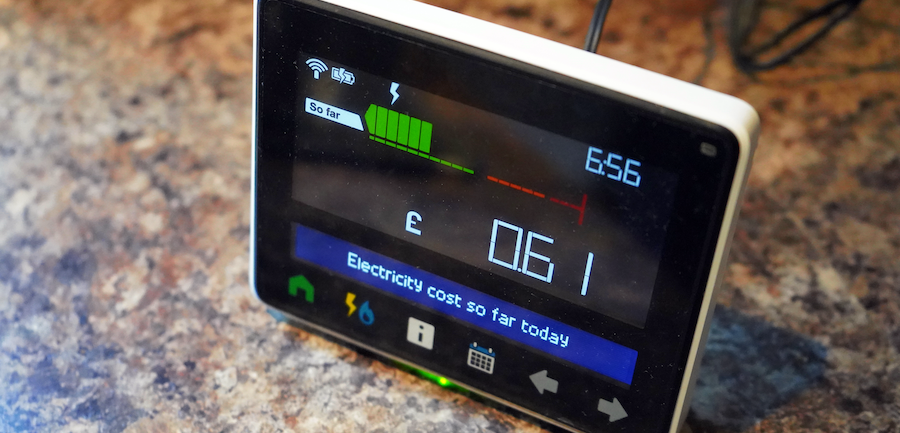

The growing use of smart meters offers the chance to deliver more flexible tariffs, eliminate manual meter readings and improve energy efficiency for households and businesses.

Rollout concerns

Despite the strong headline numbers, there are still criticisms of how the rollout is being delivered. Industry figures warn that the current approach is creating unnecessary costs and fails to capitalise on the opportunities the technology offers.

The framework that guides the rollout is due to expire at the end of 2025, prompting renewed discussion about what should happen next. Many stakeholders in the sector are calling for a more consumer-centred model, one that prioritises clear benefits for the end user and ensures smart meters contribute fully to the wider energy system.

The argument is that simply hitting installation targets is not enough. The technology has the potential to play a significant role in improving energy efficiency, supporting demand-side flexibility, and helping to manage the grid. A framework that keeps customers at the centre could help ensure that these benefits are fully realised.

Switching levels sink to lowest point this year

While smart meter installations surged in June, the number of people changing their energy supplier headed in the opposite direction. Just 228,000 customers made a move, down from 247,000 in May – an 8% fall that marked the lowest monthly switching figure of the year so far.

The slowdown continued across all customer segments. Among industrial and commercial users, switching dropped 9%, from just over 4,000 in May to just under 4,000 in June. Household switching saw an 8% fall, going from 218,000 in May to 200,000 in June.

Looking at the different types of switches gives a clearer picture:

- Large supplier to large supplier – the most common type, dropped 11% to 145,000.

- Large supplier to others (smaller or alternative providers) – a fall of 2% to 36,000.

- Others to large suppliers fell more sharply, down 19% to 31,000.

- Others to others (switching between smaller or alternative suppliers) was the only category to see growth, rising 40% to 16,000.

These figures continue a downward trend throughout 2025. With fewer customers switching to different suppliers, questions are being asked about competition in the market and how active consumers are in seeking out better deals.

What next?

While it’s great to see the smart meter rollout finally posting successful numbers again, the downward trend in supplier switching is worrying.

However, this problem (as well as some problems associated with the smart meter rollout) could be solved by tweaking the new smart meter framework at the end of 2025. A new strategy could focus not only on maintaining high installation rates but also on ensuring that smart meters are integrated into a system that gives customers the tools, confidence and incentive to engage more actively with the market.

If the sector can combine efficient, consumer-focused rollout with a competitive, dynamic supply market, it could deliver benefits that go well beyond the raw numbers. The coming months will be crucial in determining whether the industry can achieve these goals. We hope they succeed.